What is the DISC Function?

DISC is a financial function that allows you to calculate the discount rate of a bond.

DISC Formula & Parameters

The Excel function is written in the following manner:

=DISC(settlement, maturity, pr, redemption, [basis])

Parameters

- Settlement (required) – This is the date of purchase of the coupon. Also known as the settlement date, aka the date when the security is sold to the buyer.

- Maturity (required) – The date on which the security expires.

- Pr (required) – The price per $100 face value.

- Redemption (required) – The redemption value per $100 face value.

- Basis (optional) – The day count basis, possible values are:

| Basis | Day Count basis |

|---|---|

| 0 or blank | US(NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

Examples of the DISC Function

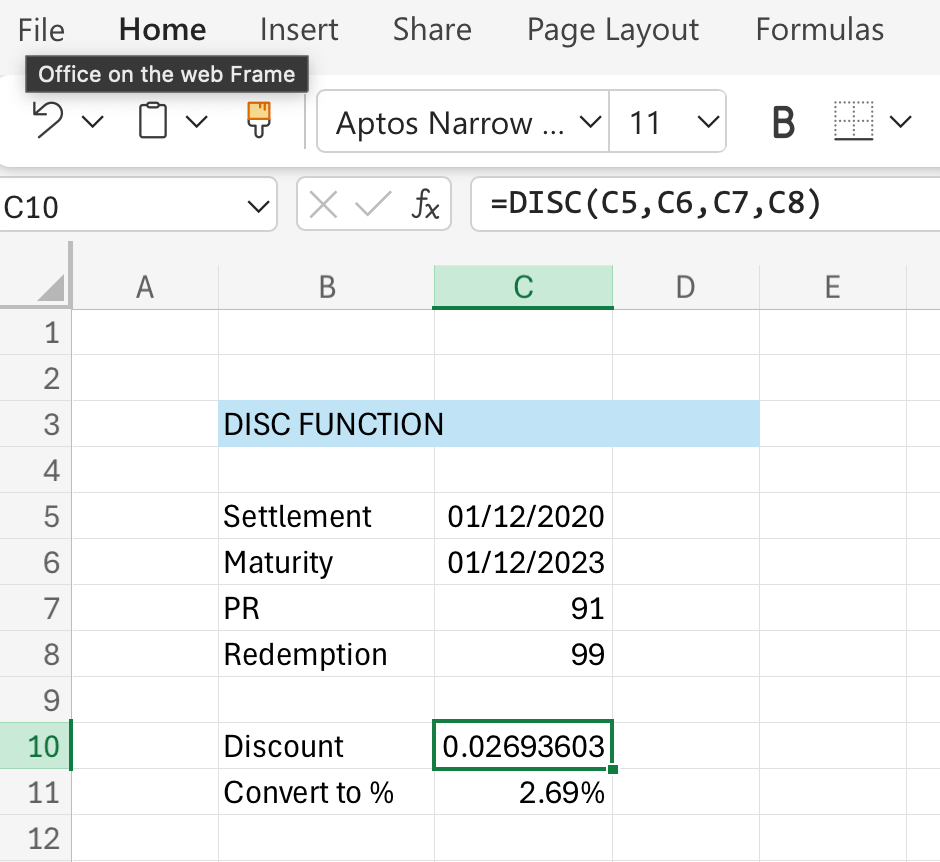

Example 1

Suppose we have the following data in our spreadsheet, this is how you apply the DISC function:

Note that we skipped the basis argument so the function took it as 0, which means it applies the US (NADS) 30/360 day count basis. If you need a different basis then refer to the parameters section above.

Important Points about the DISC Function

You could possibly get a #NUM! error if:

- Inputs for the arguments pr, redemption or basis are invalid values such as not being numbers

- Or if pr or redemption are less than or equal to 0

- Maturity date is before or on the settlement date (no-one buys an expired bond!)

- Settlement, maturity, and basis have been auto shortened to integers

#VALUE! error can be presented if:

- The given maturity date or settlement date is not a valid Excel date

- Any of the arguments are non-numeric values

Click here to download a copy of the DISC function worksheet.